Can You Make a Living? Exploring Career Paths and Financial Freedom

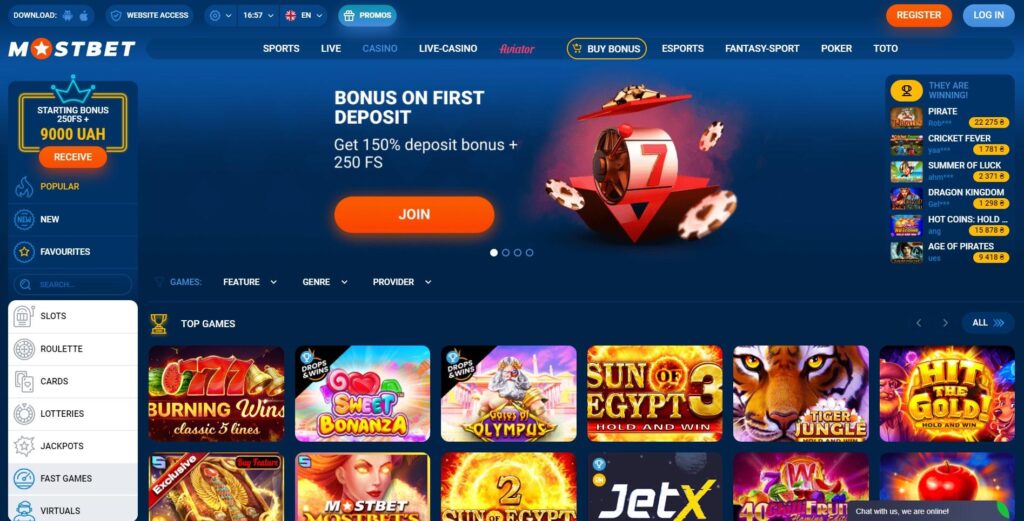

The question of whether you can make a living doing what you love is one that resonates with many. Today, more than ever, individuals are seeking career paths that not only secure their financial future but also align with their passions and interests. Whether you’re transitioning careers, entering the job market, or reevaluating your current situation, understanding your options is crucial. This article delves into various ways you can make a living, practical advice on achieving financial stability, and resources to help you along the way, including options like Can You Make a Living Playing Online Casinos in Bangladesh? https://loanpersonal.in/ for financial assistance.

The Changing Landscape of Work

In today’s fast-paced world, the traditional nine-to-five job is no longer the only route to financial independence. The rise of the gig economy, remote work opportunities, and online entrepreneurship has opened the door for individuals to explore non-conventional career paths. This shift helps people leverage their skills and passions in ways that were previously unimaginable.

1. The Gig Economy and Freelancing

The gig economy refers to the labor market characterized by short-term contracts and freelance work as opposed to permanent jobs. Websites like Upwork, Fiverr, and Freelancer enable individuals to offer their skills and services to clients around the globe. Common freelance jobs include writing, graphic design, web development, and digital marketing. Many freelancers have found a path to financial independence that provides both flexibility and the potential for high earnings.

2. Online Entrepreneurship

With the growth of e-commerce platforms such as Etsy, Shopify, and Amazon, many people have turned their hobbies into successful businesses. Whether it’s selling handmade crafts, dropshipping products, or offering online courses, the internet has made it easier than ever to start a business from home. Creating a unique product or service can lead to substantial income and the freedom to work at your own pace.

3. Remote Job Opportunities

The pandemic has accelerated the shift toward remote work, with many companies now embracing a hybrid or fully remote workforce. This shift allows individuals to seek job opportunities beyond their local job market. Platforms like Remote.co and We Work Remotely list job openings from companies looking for remote employees. The ability to work from anywhere has changed the way people approach their careers, making it easier to balance work and personal life.

Finding Your Passion and Skills

Before embarking on a new career path, it’s essential to identify your passions and transferable skills. Self-reflection can help you understand what you enjoy doing and where your strengths lie. Consider the following steps:

- Conduct a Skills Inventory: Make a list of your skills, experiences, and interests to see where they intersect.

- Seek Feedback from Others: Talk to friends, family, or mentors to gain insights about your strengths.

- Experiment: Try out different jobs or begin side projects to see what resonates with you.

The Importance of Financial Literacy

No matter what path you choose, having a strong understanding of personal finance is crucial to ensuring your financial success. Here are some important aspects of financial literacy to consider:

1. Budgeting and Saving

Understanding how to budget effectively and save money is fundamental to building a stable financial foundation. Track your income and expenses, prioritize saving for emergencies, and create a plan for long-term financial goals.

2. Investing in Your Future

Investing is an essential component of wealth building. Familiarize yourself with different investment vehicles, such as stocks, bonds, and real estate. Learning how to invest wisely can significantly impact your financial future.

3. Managing Debts

Many people face debt during their careers, whether it be student loans, credit cards, or mortgages. Understanding how to manage and reduce debt is critical to maintaining financial health. Explore options for consolidation, refinancing, and budgeting to improve your financial situation.

Networking and Building Connections

Regardless of the career path you choose, networking plays a crucial role in finding job opportunities and gaining insights into your industry. Building connections can open doors to new roles, collaborations, and mentorship. Consider joining professional organizations, attending industry conferences, and leveraging social media platforms like LinkedIn to expand your network.

Accountability and Goal Setting

Setting clear, achievable goals is vital for success in any career. Outline short-term and long-term goals, and regularly assess your progress. Holding yourself accountable will keep you motivated and focused on your journey toward making a living doing what you love.

Conclusion

Ultimately, the answer to whether you can make a living doing what you love is a resounding yes. The world is full of opportunities for those willing to pursue their passions with dedication and resilience. With the right mindset, financial literacy, and strategic planning, it’s entirely possible to create a career that not only fulfills you personally but also provides the financial stability you desire. Start exploring your options today and take the first step towards a fulfilling and financially rewarding life.